When Nexo announced that they were going to offer up to 0.05% cash back on all crypto exchanges I was excited. Of course, the “up to” was a red flag for me. Therefore, I looked into it a little more and discovered that it was based on their loyalty tiers.

Silver Tier Cashback Rate: 0.10%

Gold Tier Cashback Rate: 0.25%

Platinum Tier Cashback Rate: 0.50%

In addition, the amount is limited to $100,000 in swaps. That means if you’re platinum you can earn $500 for swapping crypto on Nexo. The fact that Nexo doesn’t charge any gas or exchange fees makes this deal even sweeter!

Or so I thought…

Figuring I’d take advantage of the free $500 since I’m platinum, I decided to start swapping crypto. It didn’t really matter what I swapped since my plan was to swap it right back.

For example, if I wanted to swap $5,000 in Bitcoin to Ether then I would swap $5,000 in Ether back to Bitcoin.

That would give me a cashback bonus of $25 in Ether and then another cashback bonus of $25 in Bitcoin.

This would use $10,000 of my $100,000 limit.

I could simply keep swapping different coins and dollar amounts until I earned my $500 in cashback bonus. With zero exchange fees, this would be $500 in pure profit. As long as I swapped the coins back and forth within seconds so that the price of the crypto didn’t fluctuate too much.

After doing this a couple of times, I noticed that something didn’t seem right.

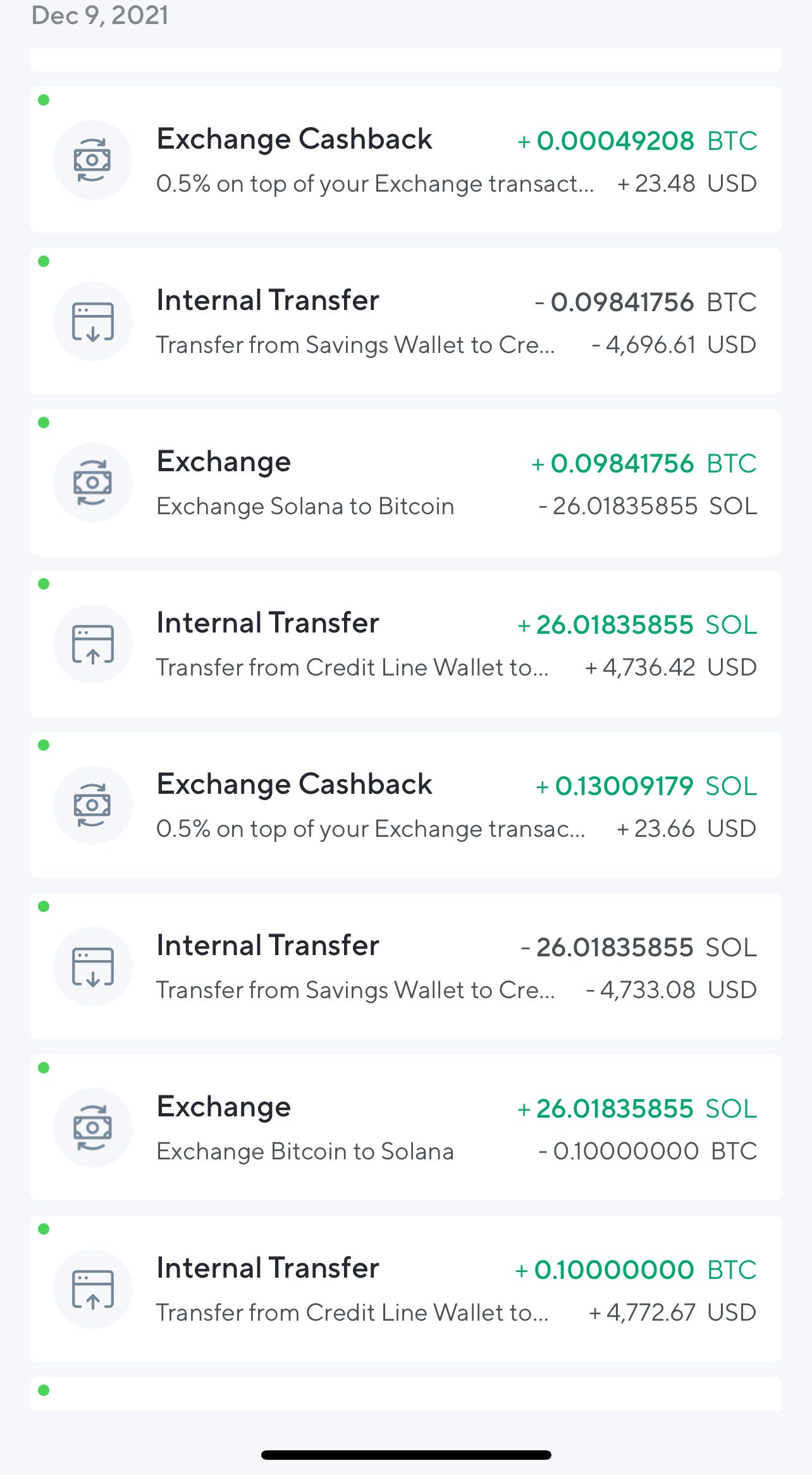

Swap 1: BTC to SOL & Vice Versa

I began with a nice even number of 0.1 BTC which, as you can see from the bottom of the photo below was worth $4,772.67 at the time. I swapped it for exactly 26.01835855 Solana and received a cash back amount of $23.66.

Take a look at the middle of the photo and you’ll see that my 26.01835855 SOL had a value of $4,736.42.

$36.25 LESS!

At the time, I didn’t know this, because I was focused on swapping the crypto back and forth within seconds so that the prices didn’t fluctuate. Therefore, I swapped my 26.01835855 SOL back to Bitcoin and expected to receive 0.1 BTC, which is what I started with.

Unfortunately, as you can see at the top of the photo, when the swap went through I received 0.09841756 BTC which had a value of $4,696.61 and $23.48 in cash back rewards.

This was $39.81 less than the Solana value and $76.06 less than what I started with. Of course, I received a total of $47.08 in cash back rewards, but that is still $28.98 LESS than what I started with!

Therefore, by swapping crypto to take advantage of the ½ a percent cash back, I ended up getting taken advantage of and losing $28.98!

At this point, I thought it could be some type of error. Therefore, I decided to conduct another trade.

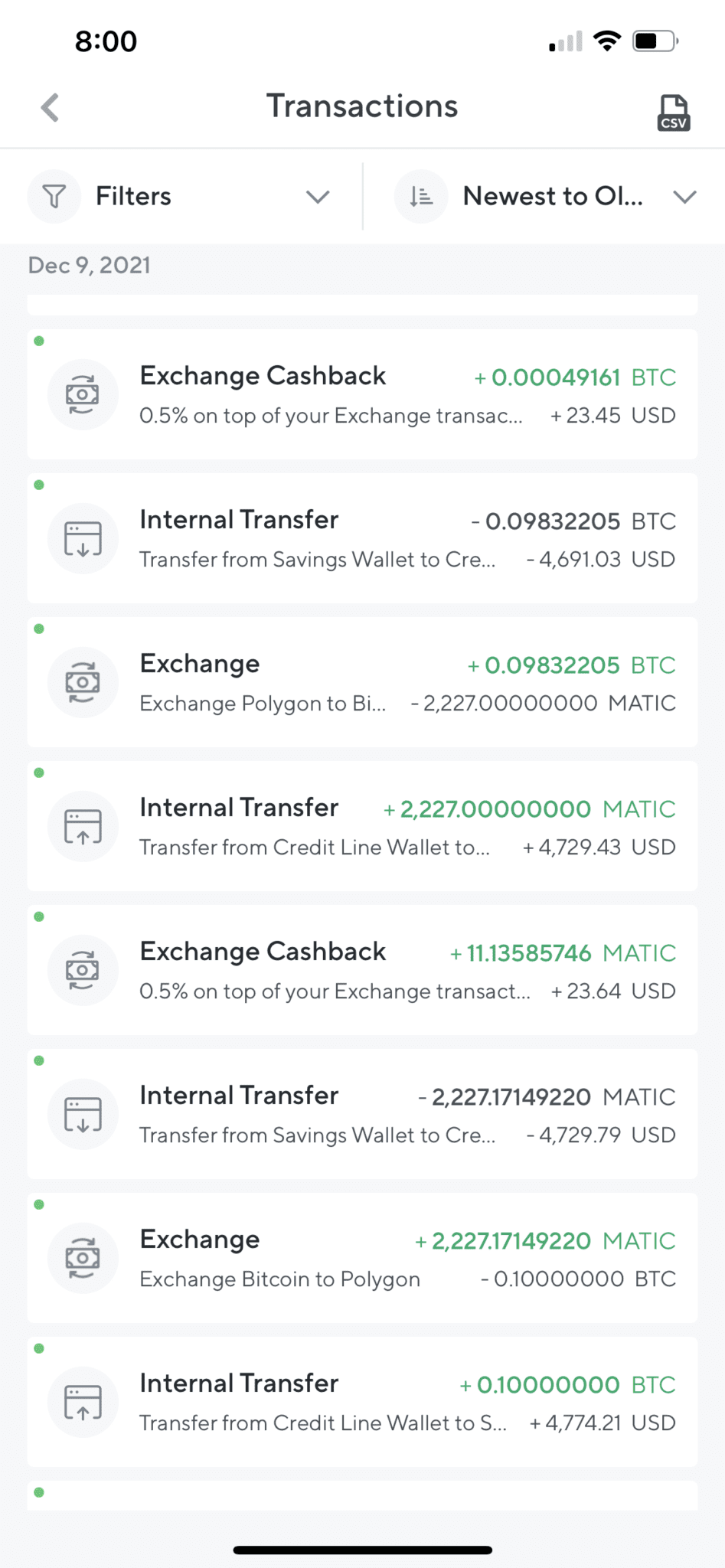

Swap 2: BTC to MATIC & Vice Versa

Once again I started out with 0.1 BTC, which was worth $4,774.21 and I received exactly 2,227.17149220 MATIC, which was worth $4,729.79 and $23.64 in cash back rewards.

$44.42 LESS!

Of course, at the time, I didn’t know because I wanted to swap my Polygon back into Bitcoin so I wouldn’t lose anything on the price fluctuating. Therefore, I swapped 2,227 MATIC, which was worth $4,729.43 back to Bitcoin.

I received 0.09832205 BTC, which was worth $4,691.03 and $23.45 in cash back rewards.

This was $38.40 less than the Polygon value and $82.82 less than what I started with. Of course, I received $47.09 in cash back rewards, but that is still $35.73 LESS than what I started with!

Now I was getting frustrated. How could this be happening? I thought I was making money not losing it! Unfortunately, now I was determined to see if Nexo was taking my money so I decided to conduct another trade and to make sure that I had enough evidence to write this article. So what if it cost me $100. As long as it would prevent other people from making the same mistake.

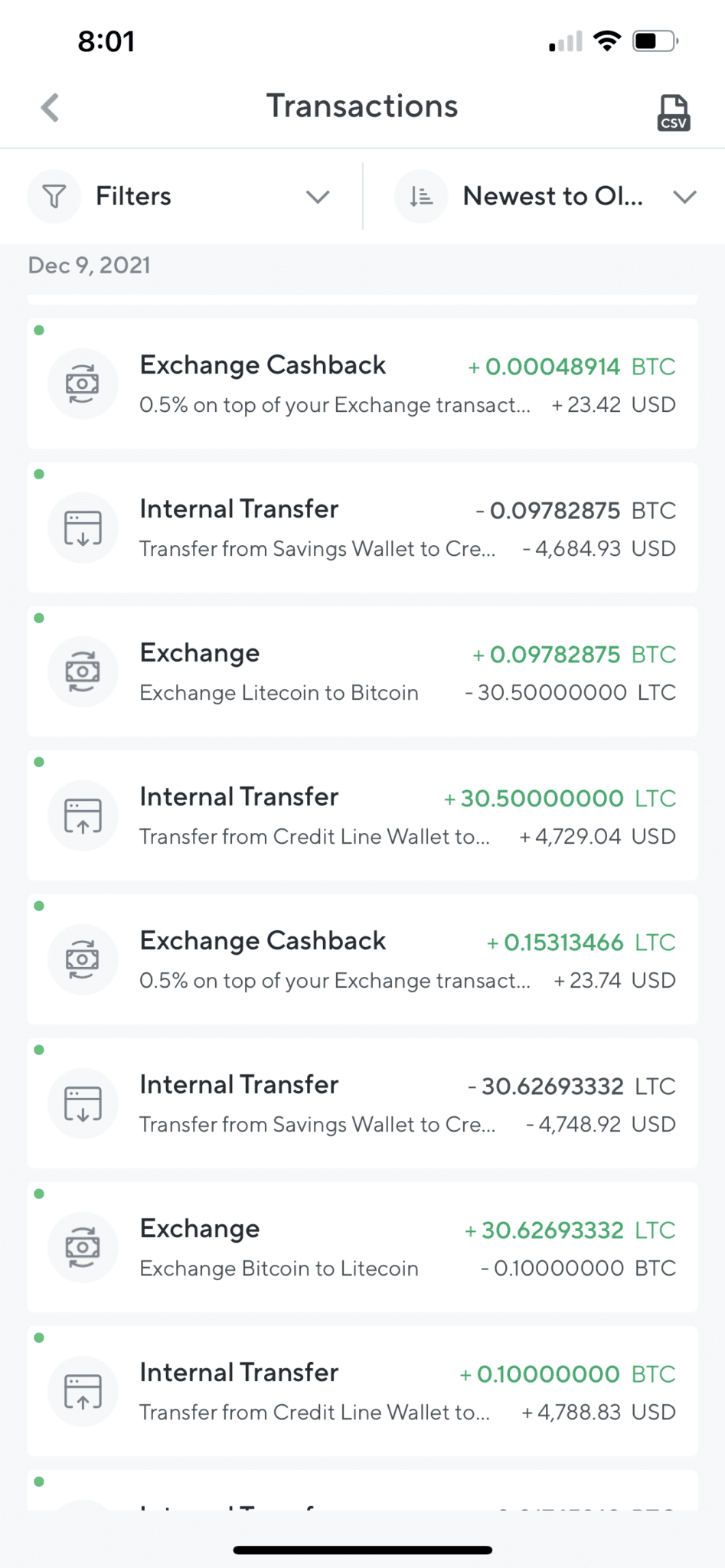

Swap 3: BTC to LTC & Vice Versa

For the final time, I started out with 0.1 BTC, which was worth $4,788.83 and I received exactly 30.62693332 LTC, which was worth $4,748.92 and $23.74 in cash back rewards.

$39.91 LESS!

Then I swapped 30.5 LTC, which was worth $4,729.04 back to Bitcoin.

I received 0.09782875 BTC, which was worth $4,684.93 and $23.42 in cash back rewards.

This was $44.11 less than the Litecoin value and $84.02 less than what I started with. Of course, I received $47.16 in cash back rewards, but that is still $36.86 LESS than what I started with!

Now I was convinced. Something was happening with my money and the money of everyone else out there. Nexo created the 1/2% cash back to get people to swap crypto and reward them for giving up their money. Exactly like a casino that pays you a third back of what you feed into the slot machine. You feel like you’re winning, meanwhile your overall balance is dwindling.

Why Would They Do This?

As much as I like to think that Nexo wouldn’t intentionally take your money like a casino, I know that they need to make money to pay the great interest rates they offer. However, I really don’t think they are a criminal company that is intentionally ripping you off. They simply aren’t telling you everything.

In an attempt to prove my theory I decided to conduct another experiment.

My hypothesis was that Nexo is selling your crypto at the lowest price, the “bid” price. Then you are buying the new crypto at the highest price, the “ask” price.

This would account for the factual monetary discrepancy when you swap from one crypto to another and vice versa within seconds. However, I’m not that much of a dummy. I wasn’t going to conduct any more swaps to prove this.

Therefore, I entered many hypothetical swaps where I tried swapping different cryptocurrencies back and forth to see what the exchange rate would be. I also checked the bid and ask prices on KuCoin, which are admittedly going to be lower than most other places, and Coinbase, which are admittedly going to be higher than most other places.

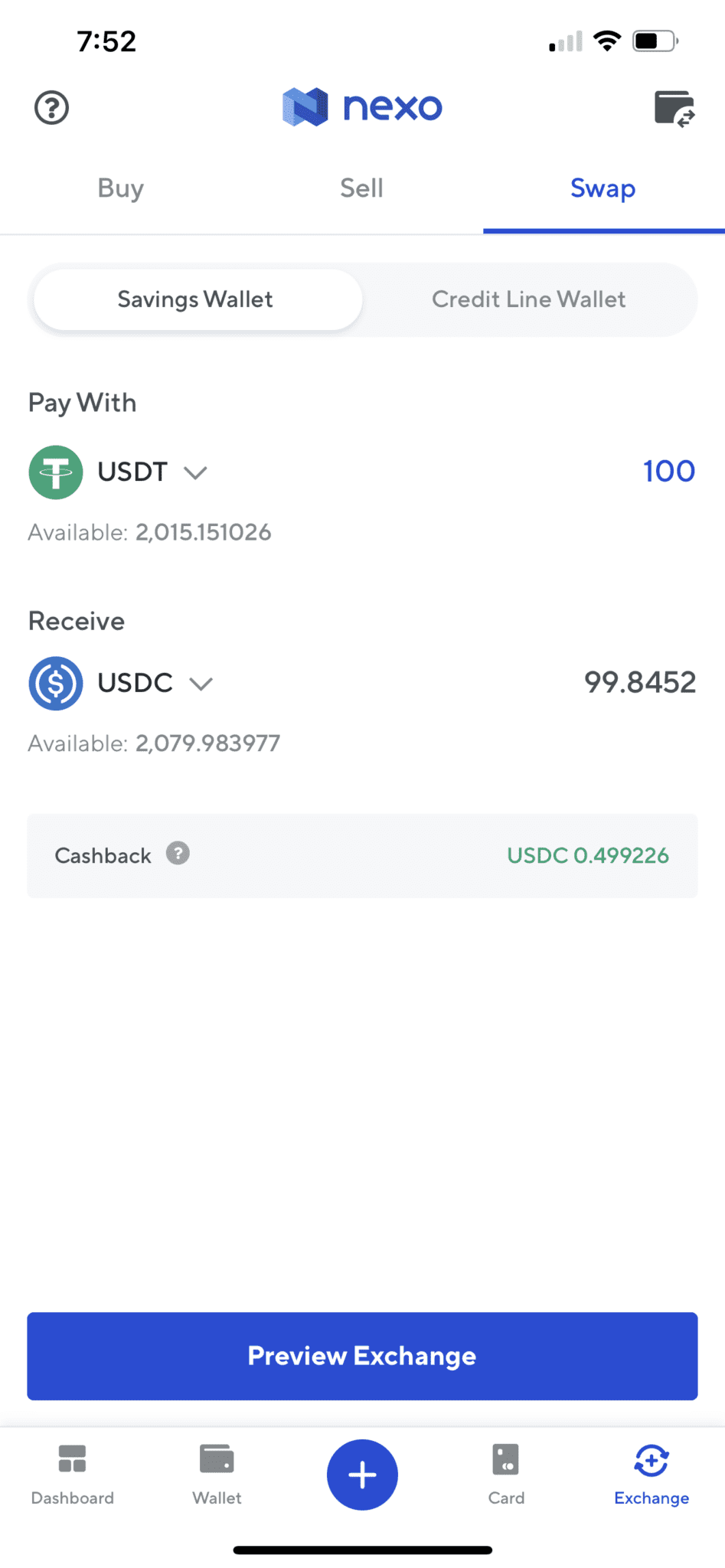

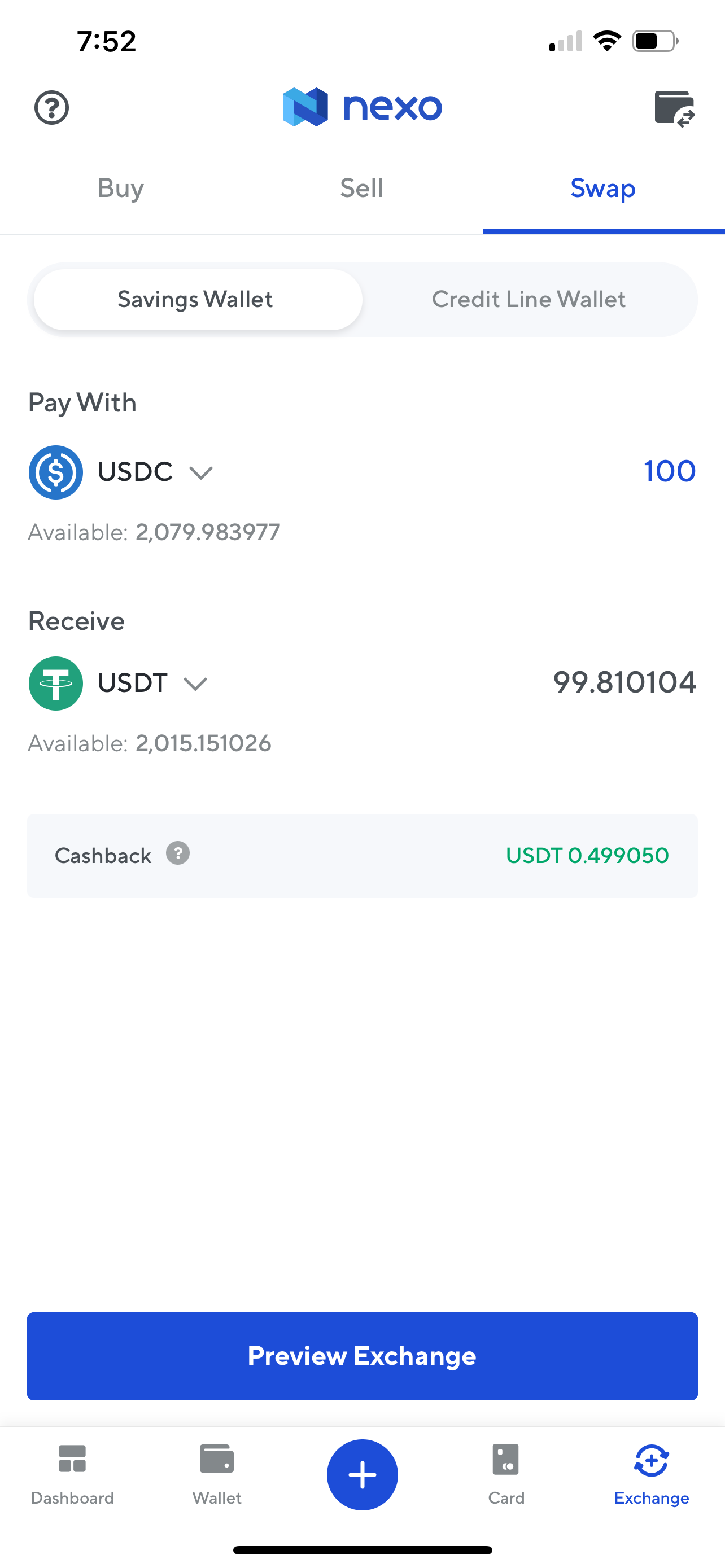

After checking several crypto pairs, I decided my hypothesis was confirmed. In an effort to take up as little of your time as possible, here are a few photos of my demonstration using a stablecoin.

For those of you who are not familiar with stablecoins, they are a coin that is guaranteed to be worth exactly $1. Provided it is a USD stablecoin. That means, that if I swap one stablecoin for another on Nexo, then I should receive exactly the same amount in each direction of the swap. In addition, I should be able to collect my cash back and not lose any money.

Now, the price of USDT and USDC is known to fluctuate a couple of pennies up or down. Therefore, at any given time USDT may be worth $1 and USDC may only be worth $0.99

Therefore, if you swapped 100 USDT, worth $100, you would receive 101 USDC worth $100.

You receive more of the worth-less currency.

However, if you swapped 100 USDC, worth $99 you would only receive 99 USDT because it is worth 99 cents on the dollar.

Check out these photos and you’ll see that I was very wrong.

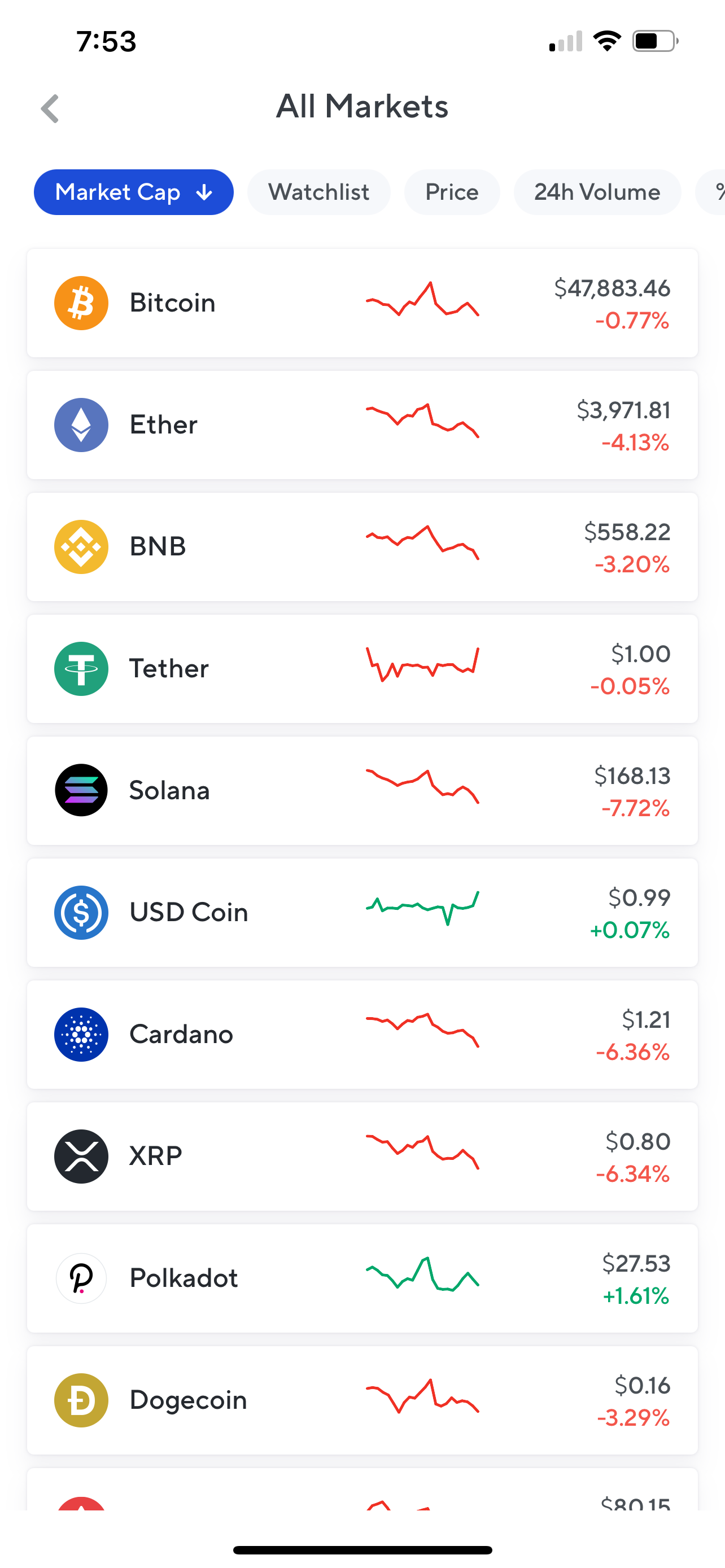

These photos show that the swap is worth the same on both ways. That is good. It is what we wanted all along. However, take a look at the photo showing the current market price of USDT and USDC provided on the Nexo exchange. This photo was taken within seconds of my performing the simulated swaps.

As you can see, USDT is in fact worth $1 and USDC is in fact worth $0.99. Therefore, the only way that the exchanges could have produced the same outcome is if you are selling on the low end and buying on the high end.

This would explain why the crypto exchanges resulted in a loss as well.

Conclusion

Is Nexo really taking your money? They are if you let them! The fact that all of my swaps resulted in a loss when they were conducted within seconds of each other is too much for coincidence. Crypto prices fluctuate, but they don’t normally fluctuate that fast.

Therefore, the only legitimate explanation is that you are selling your crypto on the low end and buying your new crypto on the high end.

Hopefully, in the future Nexo will update and allow users to specify a limit price so that you’ll have a little more control over your swaps. Until then, only swap when you have to.

Use Nexo and earn interest on your crypto assets. Stay away from swapping so that you don’t lose money. If you must swap, then only swap from stablecoins to crypto when crypto is down and only swap from crypto to stablecoins when crypto is up.

That way, you’ll be sure to have gained enough to make selling at the “bid” and buying at the “ask” worth it.

Join Nexo at https://spencercoffman.com/nexo and you’ll receive a bonus.

For more great information take a look at the supplemental content on this website and check out these great blog posts. In addition, feel free to connect with me on social media.

Thank you,

Spencer Coffman